Gestamp, a multinational company specializing in the design, development and manufacture of highly engineered metal components for the automotive industry, has released today its annual results for 2022. Gestamp has achieved the objectives set for the year, despite the challenging environment, marked by geopolitical tensions, high inflation and macroeconomic uncertainty caused by rising interest rates.

Francisco J. Riberas, Executive Chairman of Gestamp: “Despite being one of the most adverse environments in decades, the company has managed to exceed its pre-covid levels, achieving results that allow us to face the future with ambition and focused on our aim of growth taking advantage of the opportunities that the transition to electric vehicles offer."

According to Riberas, "the results achieved in 2022 once again demonstrate the strength of Gestamp's positioning, as well as the success of the strategy implemented to adapt our business to a challenging market environment as the number of vehicles produced continues to be below pre-pandemic levels while production costs remains at an historic high level."

Regarding the outlook for 2023, the Executive Chairman pointed out, "the year ahead is still marked by macro uncertainty; Gestamp continues to focus on growth, especially in new electric vehicle projects, cost control and financial discipline. The dedication and commitment of our extraordinary team puts us in a unique position to reach new milestones and drive sustainable and profitable growth in the coming years.”

Financial strength to recover pre-pandemic levels

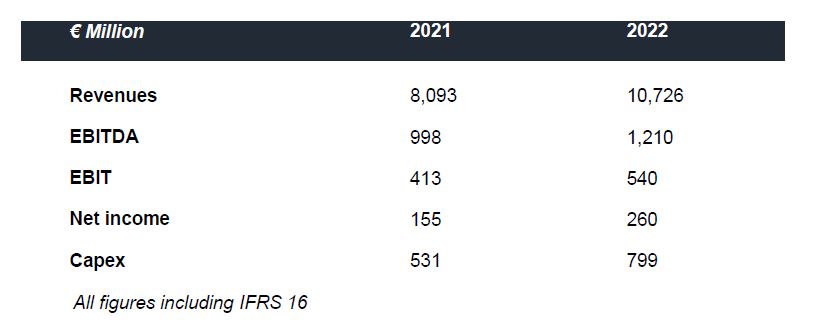

Gestamp's revenues in 2022 grew by 32.5% to reach €10,726 million, a record figure. EBITDA stood at €1,210 million, an increase of 21.2%. As for net profit in 2022, it was already above 2019 levels and reached €260 million.

On the other hand, at the closing of 2022, Gestamp has generated a free cash flow of €255 million. This has allowed the net debt figure at the end of the year to stand at €2,145 million, driving to achieve a level of leverage over EBITDA below 2 times, in line with the commitment made at the IPO in 2017. Strengthening of the balance sheet and financial discipline have been the strategic objectives that will allow Gestamp to face future challenges with greater strength.

In December 2022, Gestamp announced the payment of an interim dividend of €0.061per share. The Board of Directors has decided to propose to the upcoming Annual Shareholders’ Meeting the approval of a complementary dividend of €0.0746 per share in line with the commitment to distribute 30% of the company's net profit acquired since the IPO. As a result, Gestamp will pay a total dividend of €0.1356 against 2022 results, increasing by 67% when compared to 2021.

Significant progress in ESG

Significant progress in ESG

During the 2022 financial year, Gestamp has continued to work on its ESG strategy to promote decarbonization and strengthen its position ahead of the circular economy opportunity in the automotive sector.

On the one hand, the company continues with its plan to increase renewable energy supply in all its plants. After its implementation in 2022 in Spain and Portugal, Gestamp has signed an agreement with Cemig, a leading company in the electric power sector in Brazil, so that all its production and R&D centres in the country will fully operate with 100% renewable energy.

On the other hand, with the aim of capturing new business opportunities related to circular economy, Gestamp has acquired a stake in Gescrap Group. The company is the European leader in the management and recycling of high-quality scrap metal. Thus, Gestamp will enhance the circularity of its business model, thanks to the promotion of the use of its scrap as a secondary raw material in the production of low-emission steel. With this acquisition, Gestamp seeks to strengthen its position in the opportunity that the circularity of the economy poses for the automotive sector in its quest for decarbonization. This acquisition allows Gestamp to position itself within the low-emission steel supply chain and to seek new formulas for collaboration with its customers and steel suppliers.

Finally, in line with its commitment to society and its employees, Gestamp is collaborating with its employees at Beyçelik Gestamp, its joint venture in Turkey, to support those affected by the recent earthquakes that have affected part of Turkey.

Driving the change towards electrification

In 2022, Gestamp celebrated 25 years of history, consolidating its position as one of the market leaders in the manufacturing of vehicle components. The company continues working to drive the transition towards electric vehicles together with its customers, given the strong prospects for the sector. The number of electric vehicles produced in 2023 is expected to reach 16.4 million units (according to IHS as of December 2022), which translates into a market share of around 19%.

As the electrification opportunity gains momentum, innovation plays an increasingly important role. Gestamp is one of the market leader in innovation, which is one of the company's strategic pillars. Together with its suppliers and customers, Gestamp works to respond to the new requirements that the automotive industry needs.

During this financial year, Gestamp announced that during the year it would invest between €200 and 250 million in strategic projects for electric vehicles in three regions: North America, Europe and Asia. With this investment, Gestamp seeks to strengthen its position as a leader in the transition to electric vehicles.

Geographic diversification reinforced in Asia

Continuing our strategy of geographic diversification, as well as driving the transition to electric vehicle, Gestamp has recently announced the opening of its fourth hot stamping line in India. With this announcement, Gestamp seeks to respond to the needs of its customers and boost their path towards the mobility of the future. This is an opportunity for which the company has all the necessary technical and human resources and represents a new moment to continue adding value to a market, the Indian market, in which Gestamp was already a pioneer by introducing hot stamping.

Gestamp in 2023

2023 will continue to be a challenging year for Gestamp. Automobile production is expected to continue on the recovery path, although not reaching pre-pandemic levels until 2024. High inflation in key costs will continue to be the main challenge. In this context, Gestamp expects to continue to grow above the market in terms of sales and profitability similar to 2022, with a cash generation of more than €200 million.