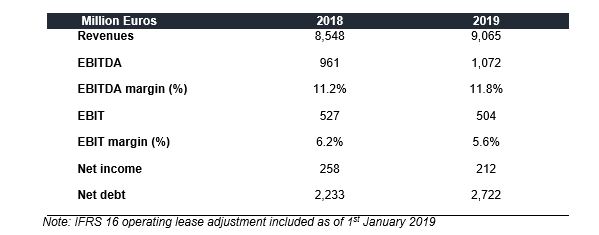

Gestamp, the multinational company specialized in the design, development and manufacture of highly engineered metal components for the automotive industry presented its results for 2019 with revenues of €9,065m in a challenging year for the automotive sector.

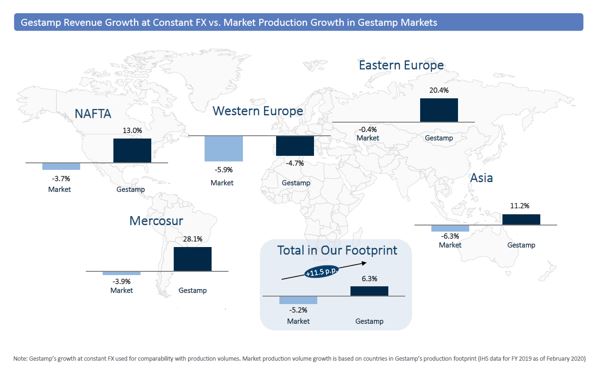

The reported revenue figure implies a 6.3% growth rate at constant FX in a market that decreased by 5.6% during this period. This has resulted in a continued outperformance by nearly 12 percentage points despite weak market conditions.

EBITDA reached €1,072m, up by 11.7% versus last year, reaching an 11.8% margin. EBIT amounted to €504m, which represents a 4.4% decrease when compared to 2018. Net income decreased by 17.6% to €212m, with a continued improvement throughout the year despite the challenging market dynamics.

Growth in revenues and EBITDA during Q4 2019

Gestamp also experienced growth in revenues during Q4 2019 by increasing 4.6% at constant FX to €2,493m and EBITDA grew by 13.5% at constant FX, up to €317m. This has resulted in an EBITDA margin improvement vs. Q4 2018, reaching 12.7%.

During Q4 2019 the auto production market declined by 4.3% in the countries where Gestamp is present. Net Income for the quarter reached €84m, which implies an improvent quarter by quarter during 2019.

Revenue by regions

Gestamp outperformed the market in all of its regions despite a challenging year. Eastern Europe reached €1,380m, a 20.4% growth rate at constant FX. NAFTA amounted to €1,976m, a 13% growth rate at constant FX.

During this period, Asia reached €1,143m, an 11.2% growth rate at constant FX. Mercosur amounted to €656m with a growth rate of 28.1% at constant FX. Western Europe decreased to €3,911m or -4.7% at constant FX.

Cost efficiency measures and Capex moderation

Gestamp is adapting to the current environment by implementing labor force flexibility, lower capex and increasing operational efficiencies with a focus on free cash flow.

Gestamp has implemented measures that include a moderation of Capex down €124m to 8.8% of revenue in 2019 (vs. 10.8% in 2018), slightly better than the revised guidance provided in October 2019. Gestamp’s invested capital provides a solid geographical footprint and technological portfolio. Further capex moderation is expected from maximizing existing investments and lower OEM needs.

Additionally, Gestamp implemented cost efficiency measures during H2 2019 with a moderate cost impact. The measures include headcount reduction in certain geographies. Further measures expected throughout 2020 in order to continue to adapt to changing market dynamics. Gestamp will focus on efficiency of operations as the number of launches decreases in relation to existing projects.

Gestamp will continue to outperform the market in 2020

In 2020, Gestamp expects to continue to outperform the market by a mid-single digit in revenues on a constant FX basis. EBITDA will be higher than in 2019 and capex will be approaching 7.5% of revenues (excluding IFRS 16).

Gestamp’s dividend policy will remain unchanged as a payout ratio of 30% of net income. The Company expects positive free cash flow generation (pre-dividends) for the year. The stated guidance excludes the systemic effect of the Coronavirus.

“The year ended has been undoubtedly challenging for the automotive sector. Despite these uncertainties, Gestamp has continued to outperform the market in revenue and EBITDA, achieving its revised 2019 full year targets,” Gestamp’s CEO, Francisco López Peña, explained.

“Auto production environment has evolved negatively over the last two years. In the short term, we are focused in investment control, labour cost flexibility and free cash flow generation,” he added.

“Gestamp is prepared to deliver sustainable development and performance and to achieve it lightweight solutions will continue to be key with heightened focus on CO2 emission and increasing EVs penetration,” López Peña concluded.

Update on Gestamp China situation

Gestamp has updated its current situation in China, where 10 out of 11 plants are in progressive start-up after the extended holiday shutdown. Gestamp’s plant in Wuhan is closed and is dependent on instructions from the Chinese Government. There are no confirmed or suspected infected employees.

Operations of Gestamp in China represent €847m in revenue, which is a 9% of Gestamp’s sales. The Company has a workforce of nearly 4.000 people in China in its 11 plants and 2 R&D centres.

“Health and safety of our people and families is our number one priority. We have a continued dialogue with all of our customers in order to assess the situation to return to normal business activity as soon as feasible,” López Peña expressed.