Gestamp, the multinational company specialized in the design, development and manufacture of highly engineered metal components for the automotive industry, has recorded solid Q3 results with an increase in EBITDA and strong free cash flow generation despite continued challenging market conditions.

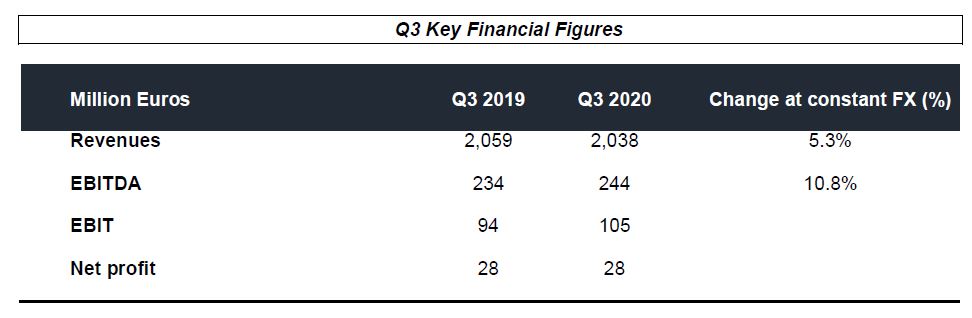

Performance during Q32020 has been solid across regions with a 7.1 p.p. revenue outperformance of auto production volumes (IHS data in Gestamp’s footprint). Revenues during Q3 2020 have reached EUR 2,038m or a 5.3% increase vs. Q3 2019 at constant FX.

EBITDA grew by 10.8% at constant FX in Q3 2020 vs. Q3 2019. Stronger EBITDA than revenue growth has led to margin expansion to 12.0% in Q3 2020 vs. 11.4% in Q3 2019. Strict cost control and execution of the Transformation Plan announced in July despite sales stabilization, led to profitability increase. Efforts have been focused on consolidating reductions in labor and operating expenses across the group, as well as specific actions in line with objectives and timings of the plan.

Net profit reached €28.4m during Q3 2020, similar to Q3 2019 despite higher FX impact and higher outflow of minority interests due to a better performance in those perimeters.

Gestamp has maintained capex discipline and reduced investments to €110m (excl. IFRS 16) or -36% during Q3 2020 vs. Q3 2019, whilst preserving customer commitments. The improvement in profitability, reduction of capex and focus on free cash flow generation has led to net debt reduction of €303m (excl. IFRS 16) to €2,348m vs. H1 2020 (€2,652m), close to Q4 2019 levels of €2,329m.

Gestamp has maintained capex discipline and reduced investments to €110m (excl. IFRS 16) or -36% during Q3 2020 vs. Q3 2019, whilst preserving customer commitments. The improvement in profitability, reduction of capex and focus on free cash flow generation has led to net debt reduction of €303m (excl. IFRS 16) to €2,348m vs. H1 2020 (€2,652m), close to Q4 2019 levels of €2,329m.

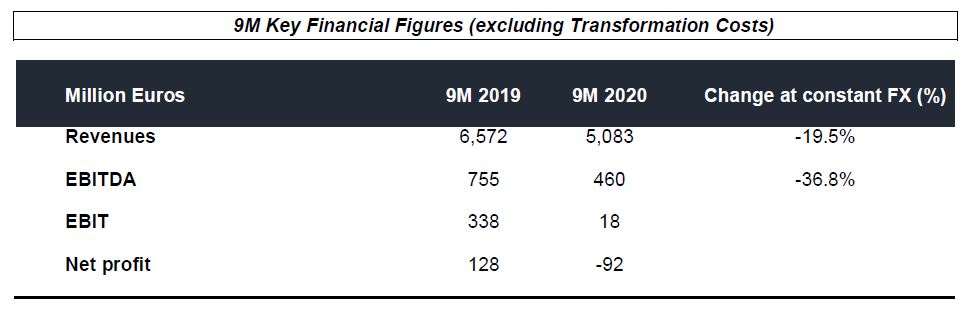

Results for the first nine months have been hampered by Q2 2020 and the impact of COVID 19. Performance during 9M 2020 has improved versus H1 2020 as a result of Gestamp’s solid Q3 2020 results. During this period, Gestamp has also continued to improve its comfortable liquidity position to €2,454m (from €1,818m in December 2019).

Gestamp has outperformed the auto production market by 3.0 p.p., impacted by its lower exposure to Asia but with an 8.5 p.p. outperformance on a weighted basis. Revenue decrease at constant FX of -19.5% (from -30.8% as of H1 2020) and an EBITDA decrease of -36.8% (from -58.2% as of H1 2020). EBITDA margin profitability has increased to 9.1% for the first nine months vs. 7.1% as of H1 2020.

In terms of guidance, the Group’s EBITDA margin is expected to be at the high end of the range (9-10% excl. TP costs), Capex target of €500m (excl. IFRS 16) is on track and net debt (excl. TP costs and IFRS 16) guidance is improved to below 2019 levels. Guidance is subject to the current COVID-19 scenario.

“Gestamp’s results in Q3 have been solid with an increase in EBITDA and strong FCF generation despite continued challenging market conditions. The Group has managed to increase its profitability to levels above 2019 and reduced its net debt significantly to levels close to Q4 2019,” Francisco Riberas, Gestamp Executive Chairman stated. “We will continue focused on executing our Transformation Plan to help drive future profitability. We will preserve and enhance our long-term strategy with our customers taking advantage of our excellent technological positioning for EVs,” he added.