Gestamp, the multinational specialized in the design, development and manufacture of highly engineered metal components for the automotive industry, today presented its 2023 first half year results. The Company's performance in this period has led to record figures at all levels in terms of revenues, EBITDA, EBIT and net profit. This solid performance has been driven by organic growth, strategic projects announced during 2022 and the contribution of the recently acquired Gescrap. These indicators’ trend since 2018 reflects the success of a business strategy based on geographic diversification, an innovative and differential product portfolio, with a focus on leading the transition to electric vehicle.

Francisco J. Riberas, Executive Chairman of Gestamp: “First-half results continue the 2022 trend, reaching record figures that are the result of our geographic diversification strategy, developing highly innovative solutions for our customers and positioning ourselves to lead the electrification of mobility that will shape the future of the automotive industry. Operational and financial discipline has enabled us to deliver record results and we continue to execute our strategy to achieve both 2023 targets and those foreseen for 2027”.

The solid results recorded in the first half of the year confirm the Company's commitments for year-end 2023 and support the objectives set out in the 2023-2027 Strategic Plan, which was recently presented at the Capital Markets Day.

Record semester for Gestamp

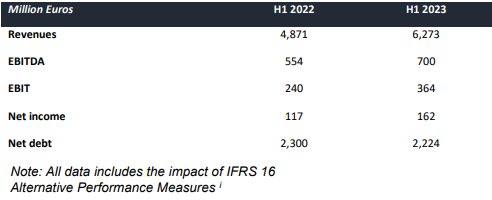

Gestamp's revenues for the period grew by 28.8% to €6,273 million, a record number for the company in a six-month period, driven by the excellent first quarter results. Consequently, the Company once again outperformed the market by 13 percentage points.

EBITDA in the first half of the year reached an all-time high in Gestamp's history, with a year-on-year increase of 26.3% to €700 million. As for the EBIT reported in the first half of the year, the increase with respect to the same period of the previous year was 51.6%, reaching €364 million.

On the other hand, the measures implemented by the company since 2020 have allowed profitability during the half-year to remain structurally high, with an EBITDA margin of 12.4% (excluding the impact of raw materials) and in line with the guidance for year-end, which remains at 12.5% - 13%.

Net income in the first half of the year was also the highest in history. The year-on-year increase of 39% brought the figure to €162 million. The company achieved this milestone despite the impact of currency devaluation in some markets during the second quarter. Growth was therefore not affected by the increase in financial expenses as a result of negative exchange rate differences, higher interest rates, and one-off costs arising from the recent refinancing carried out by the Company.

In addition, during the first six months of the year, the Company has allocated 6.8% of revenues to investments. Most of Gestamp's current investments are focused on its strategy of driving the transition to electric vehicles.

During the first half of the year, the automotive market has maintained the recovery trend in production volumes, with a year-on-year increase of over 12%. This dynamism has been driven by a solid demand, although pre-pandemic figures have not yet been recovered.

Minimum leverage level

At the end of the first half of the year, net debt stood at €2,224 million, which represents a leverage of 1.6x net debt to EBITDA, the lowest level since IPO. This figure is in line with the leverage ratio of 1.0-1.5x net debt to EBITDA set out in the 2023-2027 Strategic Plan unveiled at the Capital Markets Day.

The half-year results contribute to the achievement of the objectives set for the company both at the end of the year and in its 2023-2027 Strategic Plan. The results for the period confirm the guidance committed for 2023 and contribute to achieving the Company’s long-term objectives, which include maintaining a shareholder return of 30% of annual net profit and continuing to improve the return on invested capital.

Promoting sustainable mobility

The Company has aligned its business strategy to actively face the challenges involved in the path to neutrality in the mobility industry. To this end, Gestamp has an ESG plan that covers its production methods as well as the raw materials used, and products manufactured.

This plan includes the recent circularity agreement reached between Gestamp, ArcelorMittal and Gescrap. The alliance seeks to strengthen environmental sustainability throughout the industrial supply chain and encompasses the joint design and implementation of a circularity scheme that will enhance the reuse and recycling of steel between Gestamp and ArcelorMittal and ultimately enable to pass on these benefits to common automotive customers.

The objective of the agreement is to further promote the recycling of steel scrap for the commercial-scale production of low CO2 emissions steel products with high scrap content to meet the growing demand of the automotive market.

Market forecast

Expert estimates suggest that the vehicle production market will end 2023 with an increase of 5.3%, thus reaching 86.7 million vehicles. In the coming years, the electric vehicle segment is expected to maintain its strength and increase its market penetration from 18% in 2023 to 41% in 2027.

In this context, Gestamp has designed a strategy to be the partner supplier that accompanies its customers on their path towards electrification. Its capabilities to contribute in research, design and production of parts, together with its global presence and scalable industrial capabilities, will contribute so that by 2027 half of its revenues will come from electric vehicles.